This article offers valuable insights into the numerous advantages that come with optimising your invoicing and payment systems. We will not only explore the theoretical benefits but also provide you with a real-world example of a client who successfully underwent this transformation.

Taking a closer look at your invoicing and payment system might not sound like the most exciting task, but trust us, it’s like giving your business’s financial engine a much-needed tune-up. Think of it as the oil change for your financial operations that keeps things running smoothly. Let’s dive into why it’s important for businesses to give their invoicing and payment systems a regular check-up:

- Efficiency and automation.

A review can highlight opportunities to automate various aspects of the invoicing process, such as sending recurring invoices or integrating payment gateways for online payments. Automation reduces manual effort, minimises errors, and saves time.

- Client relationships.

Clear and well-structured invoices contribute to positive client relationships. By reviewing your invoicing system, you can ensure that invoices are transparent, easy to understand, and include all necessary information. This reduces the likelihood of misunderstandings or disputes. Clients also appreciate businesses that provide easy and convenient payment options, contributing to a positive customer experience.

- Cash flow management.

An effective invoicing and payment system helps improve cash flow by ensuring that invoices are sent out promptly, and payments are received on time. A review can identify bottlenecks or delays in the process, allowing you to take corrective actions to maintain a steady cash flow.

- Faster payments.

An optimised invoicing and payment system includes features like online payment options and automated reminders for overdue payments. These features can expedite the payment process, resulting in faster receipt of funds.

- Adaptation to business growth/scaleability.

As a business grows, the invoicing and payment needs may change. Reviewing systems allows you to assess whether it can accommodate increased transaction volumes, new payment methods, or changes in customer preferences. It also helps to identify opportunities for integration and scalability.

- Data analytics and insights.

Digitalised invoicing systems often provide reporting and analytics features. By reviewing these reports, you can gain insights into your revenue trends, outstanding invoices, and other financial metrics, which can inform your business decisions.

After collaborating with us to assess their business’s invoicing and payment system, “Client X” has successfully transitioned to a Xero accounting system for digitalising their operations. As a result, they are now benefiting from improved efficiency, smoother cash flow, reduced errors, and enhanced customer satisfaction. The time saved on administrative tasks allowed the team to concentrate on their creative work and business growth strategies. The switch to digital also positioned the business as modern and professional in the eyes of their clients.

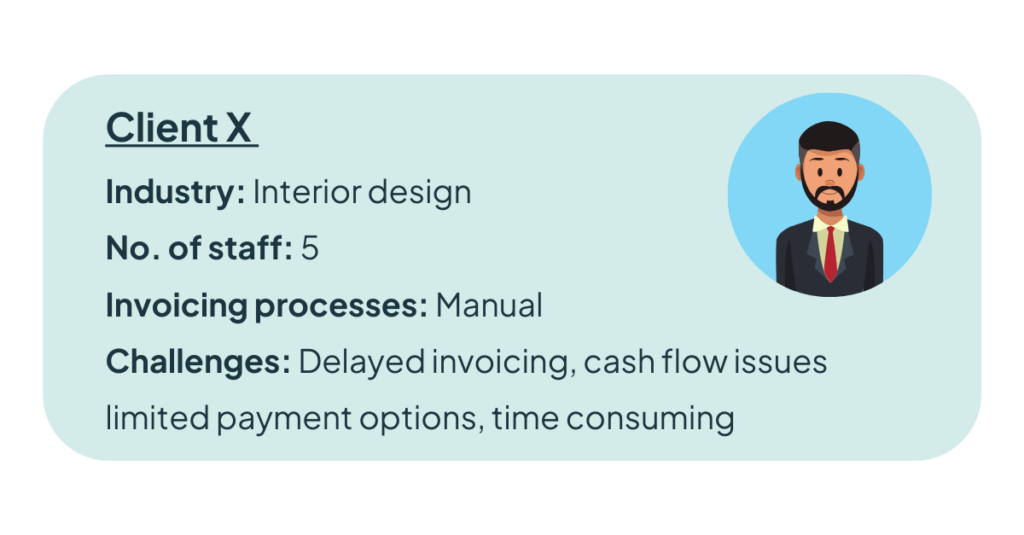

Client X is an interior design and home improvement service with five employees. Before digitalising their invoicing and payment system, they relied on manual processes using Word and Excel for creating and sending invoices, as well as receiving payments through bank transfer, cheque and cash.

Client X faced several challenges with their manual invoicing and payment system:

- Delayed invoicing. Creating and mailing paper invoices resulted in delays to client receiving them and therefore paying for the services.

- Cash flow issues. Delayed payments were causing in consistent cash flow, effecting the business’ ability to manage expenses and invest in growth opportunities.

- Time consuming admin. The system was heavily reliant on human input to raise invoices, chase them and allocate payments. Due to the lack of integration data had to be entered multiple times in multiple different places to be able to monitor and pursue invoices.

- Inconvenient payment options. Clients only had inconvenient payment options available to them leading to a delay in them making those payments and the business receive it the cash.

How reviewing these challenges led to improved operational processes:

- Faster invoicing. Invoices can now be created and sent with just a few clicks. This is significantly reducing the time it takes us to get invoices in to client’s hands.

- Timely payments. Invoices are now received instantly by clients, leading to faster payments. The automated reminders for due payments are reducing the number of overdue invoices.

- Online payment options. The software allows clients to make payments directly through the invoice using various online payment methods such as credit cards or bank transfers which is significantly speeding up the payment process.

- Improved cashflow. The quicker payments resulted in a steadier and more predictable cash flow, allowing the business to plan better and cover expenses without disruptions.

- Reduced errors. The software automatically calculating amounts and taxes, ensures accuracy in every invoice. Online payment integrations minimises errors in monies received and in financial records.

- Client satisfaction. Clients appreciated the convenience of online payments and receiving electronic invoices. The professional presentation of invoices reflected positively on the business.

- Time savings. The streamlined process is saving significant time for the employees, allowing them to focus more on their core work and customer relationships.

- Financial insights. The software is providing real-time insights into unpaid invoices, revenue trends, and overall financial health, enabling informed decision-making.

- Better record keeping. The digital records are more easily searchable and accessible making it simpler to track customer history, generate reports and get rid of the problem of paper storage!

To find out more about improving your invoicing and payments, and how Cottons can assist you, please contact Emma Reid: